The Future of Payments: ‘From Cash to Digital Wallets’

The way we make payments is constantly evolving, with new technologies and innovations changing the way we exchange money. Cash has been the primary mode of payment for centuries, but now digital wallets are gaining popularity.

In this blog, I will explore the future of payments, and how digital wallets are changing the way we pay.

The Rise of Digital Wallets:

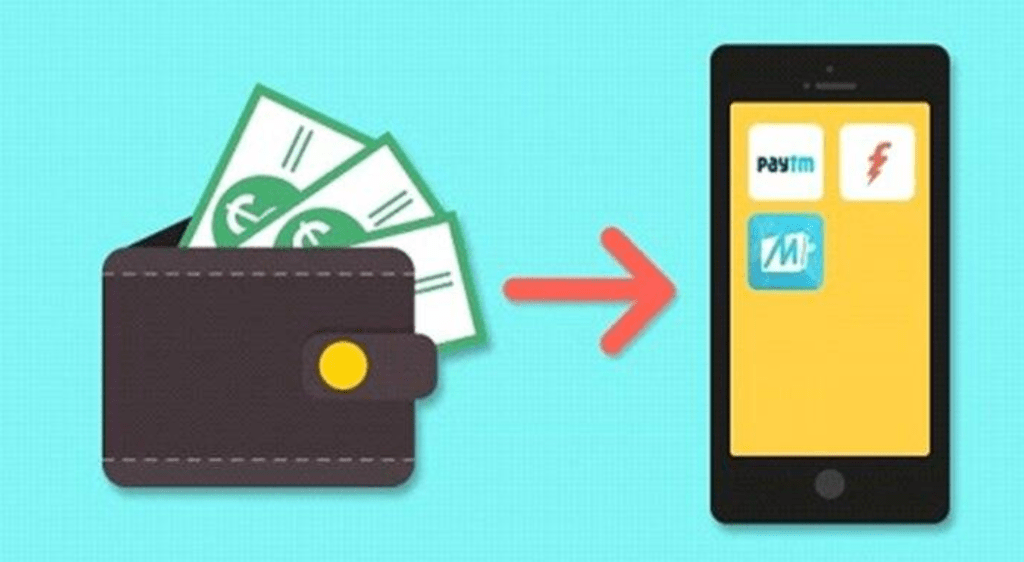

Digital wallets, also known as e-wallets, are electronic devices or software applications that store payment information, such as credit and debit card details, and allow users to make transactions using their mobile devices. Digital wallets are becoming increasingly popular, with many users preferring them over cash and traditional payment methods. According to a report by Statista, the global mobile payment market is expected to reach $4.9 trillion by 2023.

lets take an example now that actually describes the future of payments through ‘Digital wallet’.

In 1997, Coca Cola set up vending machines that allowed users to pay by text, in the first noted mobile phone payment in history. Within 10 years a mobile money transfer system called M-Pesa launched in Kenya in 2007 and in 2011 Google embraced mobile phone payments fully, launching the first ever, mass-market digital wallet.

Now, physical wallets are set to be cast aside in favour of digital ones, as mobile phone payments continue to grow faster than any other payment method.

Mobile network operators bill over a trillion dollars to more than 5 billion people every year. There has also been a reported 54% decline in the number of cash transactions in the UK from 2010 to 2020, and payments initiated from mobile phones are predicted to become the second most common way to pay in the UK (after debit cards) by 2022.

Benefits of Digital Wallets:

Convenience:

Digital wallets allow users to make payments quickly and easily, without the need for cash or physical cards. With just a few taps on their mobile devices, users can complete transactions and make purchases.

Security:

Digital wallets offer increased security compared to traditional payment methods. Most digital wallets use encryption technology to protect payment information and prevent fraud

Integration:

Digital wallets can be integrated with other applications and services, such as loyalty programs and mobile banking apps, making it easy for users to manage their finances and rewards in one place.

Contactless Payments:

Digital wallets allow users to make contactless payments, which is especially important in the era of the COVID-19 pandemic. Contactless payments eliminate the need for physical contact and help reduce the spread of germs.

Are digital wallet payments safe?

Digital wallet payments can be safe, as long as certain precautions are taken. Like any payment method, there is always some risk involved, but there are measures you can take to ensure the safety of your digital wallet transactions. Here are some ways digital wallet payments can be safe:

Password Protection: Most digital wallets require a password or PIN to access them. Ensure that your password is strong and not easily guessable. Avoid using the same password for multiple accounts.

Two-Factor Authentication: Many digital wallets offer two-factor authentication, which adds an extra layer of security. With two-factor authentication, a user needs to provide two forms of identification to access their digital wallet.

Secure Network: When making a payment using a digital wallet, ensure that you are using a secure network, such as a private Wi-Fi network or a cellular network. Public Wi-Fi networks can be vulnerable to hacking and may compromise your payment information.

Encryption: Digital wallets use encryption technology to protect payment information. Ensure that the digital wallet you use employs encryption technology to secure your payment data.

Use Trusted Apps: Only download digital wallet apps from trusted sources, such as the Apple App Store or Google Play Store. Avoid downloading apps from third-party sources, which may be unsafe and may contain malware.

Keep Your Device Secure: Ensure that your mobile device is secure by using a password or PIN to access it. Avoid leaving your device unlocked or unattended.

Monitor Your Transactions: Regularly check your digital wallet transactions to ensure that there are no unauthorized transactions. If you notice any suspicious activity, contact your digital wallet provider immediately.

Conclusion:

Digital wallet payments can be safe if certain precautions are taken. Password protection, two-factor authentication, using a secure network, encryption, using trusted apps, keeping your device secure, and monitoring your transactions are all ways to ensure the safety of your digital wallet transactions. By following these best practices, you can enjoy the convenience and security of digital wallet payments.

Add Comment

You must be logged in to post a comment.