Named Entity Recognition (NER) For Banking

Named Entity Recognition (NER) is a powerful natural language processing technique that is increasingly being used by the banking industry to improve customer experience, automate processes, and gain valuable insights from unstructured data. In this blog, we’ll explore the many ways that NER is being used in banking and finance, and discuss some of the benefits and challenges of this technology.

What is Named Entity Recognition?

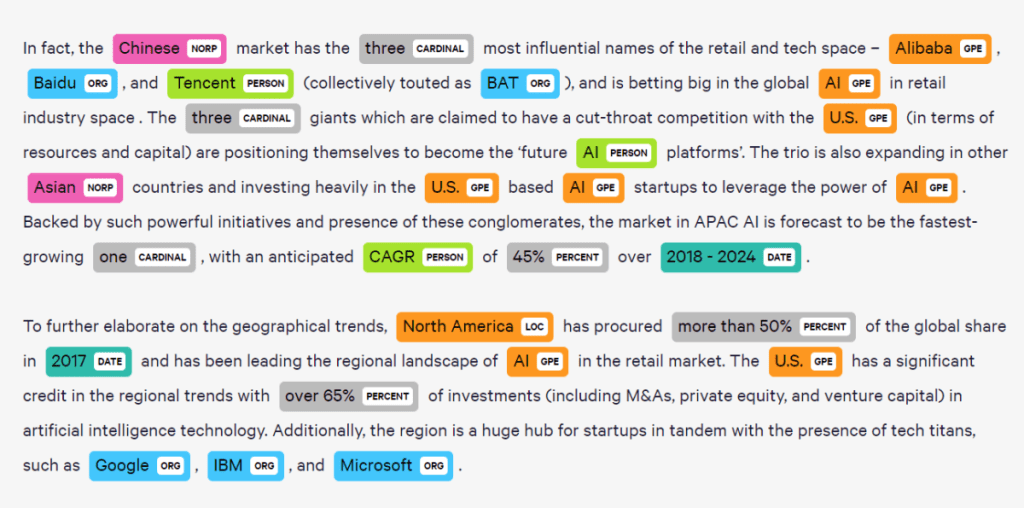

Named Entity Recognition is a subfield of natural language processing that focuses on identifying and extracting important entities from unstructured text data. Entities can include people, places, organizations, dates, and other named objects that are relevant to a particular domain.

In the banking industry, NER is used to identify and extract key information from unstructured text data, such as customer support inquiries, social media posts, and news articles. This information can then be used to improve customer experience, automate processes, and gain valuable insights into customer behavior and sentiment.

Use Cases for NER in Banking

There are many potential use cases for NER in banking and finance. Here are just a few examples:

Customer Service: NER can be used to automatically extract key information from customer support inquiries, such as the customer’s name, account number, and issue description. This information can then be used to provide more personalized and efficient support to customers, reducing response times and improving overall satisfaction.

Fraud Detection: NER can be used to identify potential instances of fraud by analyzing unstructured text data, such as emails and chat logs. By identifying key entities such as names, addresses, and phone numbers, NER can help detect suspicious activity and prevent fraudulent transactions.

Compliance: NER can be used to identify and extract key entities from regulatory documents, such as contracts and legal agreements. This can help banks ensure compliance with regulatory requirements and avoid costly penalties.

Market Analysis: NER can be used to analyze news articles, social media posts, and other unstructured data sources to identify key entities such as companies, products, and industry trends. This information can be used to gain valuable insights into market sentiment and make more informed investment decisions.

Benefits of NER in Banking

There are many benefits to using NER in banking and finance, including:

Improved Customer Experience: By automating the process of extracting key information from customer support inquiries, banks can provide more personalized and efficient support to customers, reducing response times and improving overall satisfaction.

Increased Efficiency: By automating processes such as fraud detection and compliance monitoring, banks can save time and resources, improving overall efficiency and reducing costs.

Better Insights: By analyzing unstructured data sources such as news articles and social media posts, banks can gain valuable insights into market sentiment and customer behavior, which can inform investment decisions and improve overall business strategy.

Challenges of NER in Banking

While NER has many potential benefits for banking and finance, there are also several challenges that need to be addressed. These include:

Data Quality: NER relies heavily on the quality of the data it is trained on. In order to achieve accurate results, banks need to ensure that their data is clean, well-structured, and relevant to the domain they are working in.

Bias: NER models can be biased if they are trained on data that is not representative of the population they are meant to serve. Banks need to ensure that their models are trained on diverse and representative datasets to avoid bias.

Privacy and Security: NER relies on access to large amounts of data, which can raise concerns around privacy and security. Banks need to ensure that they are complying with relevant data protection laws and implementing appropriate security measures to protect sensitive data.

Conclusion

Named Entity Recognition is a powerful technology that is increasingly being used in banking and finance to improve customer experience, automate processes.

Add Comment

You must be logged in to post a comment.