“Transforming the BFSI Landscape: The Power of Generative AI”

Data security and regulatory compliance are critical concerns for the BFSI sector. Generative AI algorithms can identify potential security breaches, detect anomalies, and strengthen cybersecurity measures. These algorithms can analyze vast amounts of data, monitor network activities in real-time, and identify suspicious patterns that may indicate a cyber attack. Moreover, Generative AI can assist in regulatory compliance by automating data privacy checks, identifying potential violations, and generating compliance reports, thereby reducing the risk of penalties and reputational damage

The financial industry has always been at the forefront of technological advancements, constantly seeking innovative ways to improve operations, enhance customer experiences, and mitigate risks. In recent years, one technology that has gained significant attention and revolutionized the BFSI sector is Generative Artificial Intelligence (AI). With its ability to create new and original content, Generative AI is reshaping the way financial institutions operate, making processes more efficient, personalized, and secure. In this blog, we will explore the fascinating world of Generative AI in BFSI and its profound impact on the industry.

The Rise of Generative AI:

Generative AI is a subset of artificial intelligence that focuses on creating new and original content, ranging from text and images to music and videos. It employs complex algorithms and deep learning techniques to understand patterns and generate new outputs that mimic human creativity. In the BFSI sector, Generative AI has emerged as a powerful tool for various applications, including fraud detection, risk assessment, customer engagement, and financial forecasting.

Enhancing Fraud Detection and Risk Assessment:

Fraudulent activities pose a significant threat to financial institutions, costing billions of dollars each year. Generative AI algorithms can analyse vast amounts of data, detect patterns, and identify potential fraud cases with remarkable accuracy. By continuously learning from new data and adapting to evolving tactics, Generative AI algorithms can stay one step ahead of fraudsters, mitigating risks and safeguarding the financial system.

Personalised Customer Engagement:

In today’s digital era, customer expectations have soared, demanding highly personalised experiences. Generative AI empowers BFSI institutions to deliver tailored services by analysing customer data, preferences, and behavior. Chatbots powered by Generative AI can engage in natural language conversations, answer queries, and provide personalised financial advice, enhancing customer satisfaction and loyalty. Additionally, Generative AI can generate personalised investment portfolios, insurance plans, and loan recommendations, aligning with individual needs and goals.

Financial Forecasting and Market Analysis:

Accurate financial forecasting is crucial for making informed decisions and mitigating risks. Generative AI algorithms can analyze historical financial data, market trends, and macroeconomic indicators to generate forecasts with improved accuracy. By considering a wide range of variables and their interdependencies, Generative AI empowers financial institutions to make more precise predictions regarding stock prices, interest rates, and currency fluctuations. This aids traders, analysts, and investors in making well-informed decisions, resulting in improved profitability and reduced market volatility.

Automating Back-Office Operations:

The BFSI sector involves numerous back-office operations that are time-consuming, repetitive, and prone to errors. Generative AI algorithms can automate these tasks, streamlining processes, reducing operational costs, and enhancing efficiency. For instance, Generative AI can generate automated reports, perform data reconciliation, and streamline compliance processes by analysing vast volumes of regulatory information. This frees up human resources to focus on more complex tasks, such as strategic planning, risk management, and customer engagement.\

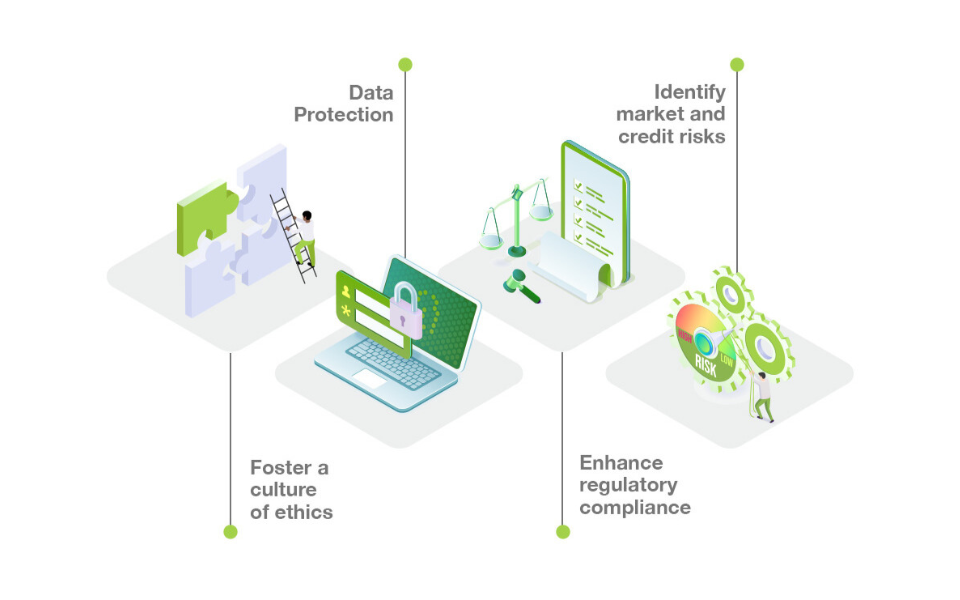

Ensuring Security and Compliance:

Credit Risk Assessment: Traditional credit risk assessment processes rely heavily on historical credit scores and limited data points. Generative AI can revolutionize credit risk assessment by incorporating alternative data sources, such as social media profiles, online shopping patterns, and mobile phone usage data. This enables a more comprehensive and accurate evaluation of an individual’s creditworthiness, allowing financial institutions to make better lending decisions.

Algorithmic Trading and Investment Strategies: Generative AI algorithms can analyse vast amounts of financial data, market trends, and historical patterns to develop sophisticated trading algorithms and investment strategies. These algorithms can identify trading opportunities, optimize portfolio allocations, and execute trades with speed and precision, leading to improved investment performance and profitability.

Cybersecurity and Fraud Detection: The BFSI sector faces constant threats from cyberattacks and data breaches. Generative AI can enhance cybersecurity measures by analyzing network traffic, identifying potential vulnerabilities, and developing adaptive defense mechanisms. It can also detect fraudulent activities, such as phishing attacks and identity theft, by analyzing patterns in communication and user behavior.

Regulatory Reporting and Compliance Automation: The BFSI sector is subject to a myriad of regulations and reporting requirements. Generative AI can automate the process of generating regulatory reports, ensuring accuracy and efficiency. By analysing vast amounts of data and extracting relevant information, Generative AI algorithms can generate compliance reports, reducing the burden on compliance teams and minimising the risk of errors.

Wealth Management and Financial Planning: Generative AI algorithms can generate personalized financial plans based on individual goals, risk tolerance, and market conditions. These algorithms can provide investment recommendations, retirement planning strategies, and wealth management solutions tailored to each client’s unique circumstances, enabling financial institutions to deliver highly customized and effective financial planning services.

Sentiment Analysis and Market Sentiment Tracking: Generative AI algorithms can analyse social media, news articles, and other textual data to gauge market sentiment and investor sentiment. By monitoring public sentiment, financial institutions can gain valuable insights into market trends, investor behaviour, and potential shifts in market sentiment, allowing them to make informed investment decisions and manage portfolios effectively.

Product Development and Innovation: Generative AI can assist in the development of new financial products and services by analyzing customer preferences, market trends, and historical data. By generating innovative ideas and simulating potential outcomes, financial institutions can design products that meet evolving customer needs, attract new customers, and gain a competitive edge in the market.

Generative AI and chatbots have become a powerful combination in the BFSI sector, transforming customer interactions, improving efficiency, and enhancing overall customer experiences. Let’s delve deeper into how Generative AI empowers chatbots in the BFSI industry:

Natural Language Processing (NLP): Generative AI algorithms equipped with NLP capabilities enable chatbots to understand and interpret natural language conversations. This allows customers to interact with chatbots in a conversational manner, making the experience more intuitive and user-friendly. Customers can ask questions, seek assistance, and engage in personalised discussions with chatbots, mimicking human-like interactions.

Personalized Customer Engagement: Chatbots powered by Generative AI can analyze customer data, transaction history, and preferences to provide personalised recommendations and tailored services. These chatbots can understand customer needs, offer product suggestions, assist with financial planning, and provide relevant information based on individual circumstances. This level of personalisation enhances customer engagement, satisfaction, and loyalty.

24/7 Availability and Instant Support: Chatbots powered by Generative AI algorithms can operate round the clock, providing instant support and resolving customer queries at any time. This eliminates the need for customers to wait for business hours or navigate complex phone menus to reach a customer service representative. The immediate availability of chatbots enhances customer convenience and ensures timely assistance.

Streamlined Account and Transaction Management: Generative AI-powered chatbots can handle various account-related tasks, such as balance inquiries, transaction history retrieval, and fund transfers. By integrating with banking systems, these chatbots can execute transactions, provide real-time updates, and offer self-service options for customers, reducing the need for manual intervention and streamlining account management processes.

Fraud Detection and Security: Chatbots backed by Generative AI algorithms can contribute to fraud detection and security measures. They can analyze customer interactions, transaction patterns, and behavioral data to identify potential fraudulent activities or suspicious behavior. In such cases, chatbots can alert customers, provide guidance on security best practices, and assist in reporting potential fraud incidents to the appropriate authorities.

Interactive Financial Education: Generative AI-powered chatbots can serve as financial education tools, providing users with valuable information about various financial topics, such as budgeting, investing, and debt management. These chatbots can deliver educational content, answer financial literacy-related questions, and guide users through interactive learning experiences, empowering individuals to make informed financial decisions.

Seamless Integration with Backend Systems: Chatbots leveraging Generative AI algorithms can integrate seamlessly with backend systems, such as customer relationship management (CRM) software, core banking systems, and data analytics platforms. This integration enables chatbots to access real-time customer information, provide accurate and up-to-date responses, and perform transactions securely within the existing infrastructure of the financial institution.

Continuous Learning and Improvement: Generative AI-powered chatbots can continuously learn from customer interactions, feedback, and data. Through machine learning techniques, these chatbots can improve their responses, understand user preferences better, and refine their capabilities over time. This ensures that chatbots evolve and deliver more accurate and relevant information to customers, enhancing the overall customer experience.

Generative AI has unlocked new possibilities for chatbots in the BFSI sector, enabling them to offer personalised, efficient, and intelligent support to customers. As technology advances and Generative AI continues to evolve, we can expect even more sophisticated chatbot capabilities, ultimately transforming the way customers interact with financial institutions.

Leading Tools in Generative AI for BFSI:

OpenAI’s GPT-3: OpenAI’s GPT-3 (Generative Pre-trained Transformer 3) is one of the most powerful and widely known Generative AI models. It has the capability to generate human-like text and can be harnessed for a range of BFSI applications, including chatbots, fraud detection, and personalized customer engagement.

Google’s DeepMind: Google’s DeepMind is an advanced AI research group that has made significant contributions to the field of Generative AI. Their cutting-edge algorithms and models can be leveraged to enhance various BFSI applications, such as risk assessment, fraud detection, and market analysis.

IBM Watson: IBM Watson, an AI platform, offers a range of tools and services that can be utilized in the BFSI sector. Watson’s natural language processing capabilities and machine learning algorithms enable the development of sophisticated chatbots, fraud detection systems, and personalized financial advisory services.

NVIDIA’s DALL-E: NVIDIA’s DALL-E is an impressive Generative AI model that specializes in generating images from textual descriptions. In the BFSI sector, DALL-E can be leveraged for data visualization, creating personalized infographics, and generating visual representations of financial data for better understanding and decision-making.

Amazon Web Services (AWS) AI Services: AWS provides a suite of AI services, including natural language understanding (NLU) and text-to-speech capabilities, which can be utilized for building advanced chatbot systems. These services enable BFSI institutions to create conversational interfaces that understand and respond to customer queries effectively.

As technology advances and the demand for Generative AI in the BFSI sector grows, we can expect further innovation and the emergence of new tools and platforms specifically tailored to the industry’s needs. Financial institutions that embrace and leverage Generative AI will have a competitive edge, enabling them to provide superior customer experiences, improve operational efficiency, and stay at the forefront of the rapidly evolving BFSI landscape.

In conclusion, Generative AI is revolutionizing the BFSI sector, ushering in a new era of innovation, efficiency, and customer-centricity. From personalized customer engagement and fraud detection to risk management and regulatory compliance, Generative AI is reshaping how financial institutions operate and interact with their customers.

The future of Generative AI in BFSI holds immense potential. With advancements in technology and the continuous evolution of algorithms, we can expect even more sophisticated applications and capabilities. Hyper-personalization, enhanced fraud detection, automated risk management, and streamlined compliance processes are just a glimpse of what lies ahead.

As financial institutions embrace Generative AI, they can unlock new levels of efficiency, risk mitigation, and customer satisfaction. Those who adapt and capitalize on this technology will be well-positioned to thrive in the digital age and gain a competitive edge in an industry that demands constant innovation.

The future of BFSI belongs to those who embrace Generative AI, transforming the way financial services are delivered, ensuring seamless customer experiences, and shaping the industry’s landscape for years to come.

Add Comment

You must be logged in to post a comment.