Transaction Categorization Using ML in BFSI Domain

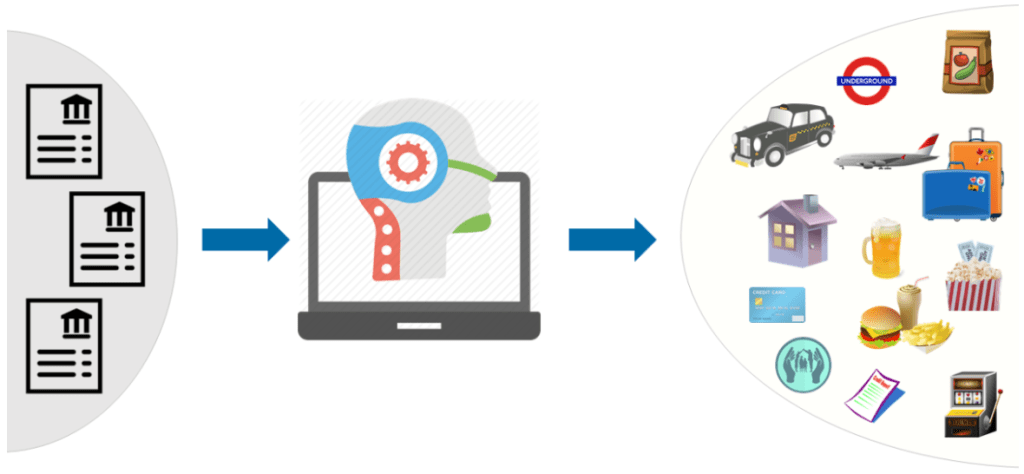

Transaction classification is the process of categorizing transactions based on their underlying nature and purpose. It is an important task for various industries, including finance, retail, and e-commerce. By accurately classifying transactions, organizations can gain insights into their business operations, identify fraudulent transactions, and improve their decision-making processes.

In finance, transaction classification is commonly used for categorizing expenses for personal and business accounting purposes. For example, a bank transaction might be classified as a utility bill payment, a rent payment, or a credit card purchase. This information can then be used to create a budget, monitor spending patterns, and identify potential areas for cost savings.

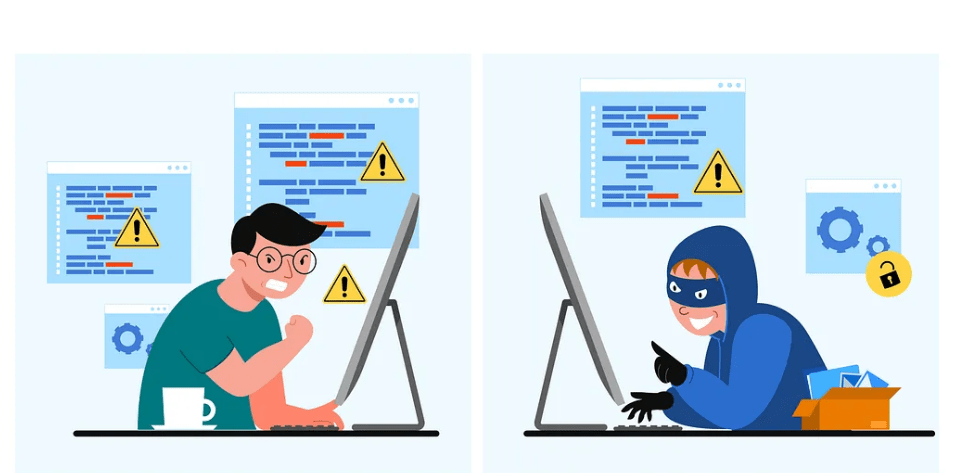

In e-commerce, transaction classification can be used for fraud detection and prevention. By analyzing transaction data and comparing it to historical patterns, organizations can identify suspicious activity and prevent fraudulent transactions before they occur.

One of the key challenges in transaction classification is dealing with the large volume of data. With millions of transactions occurring each day, it is impractical to manually classify each one. Instead, automated techniques such as machine learning can be used to classify transactions at scale.

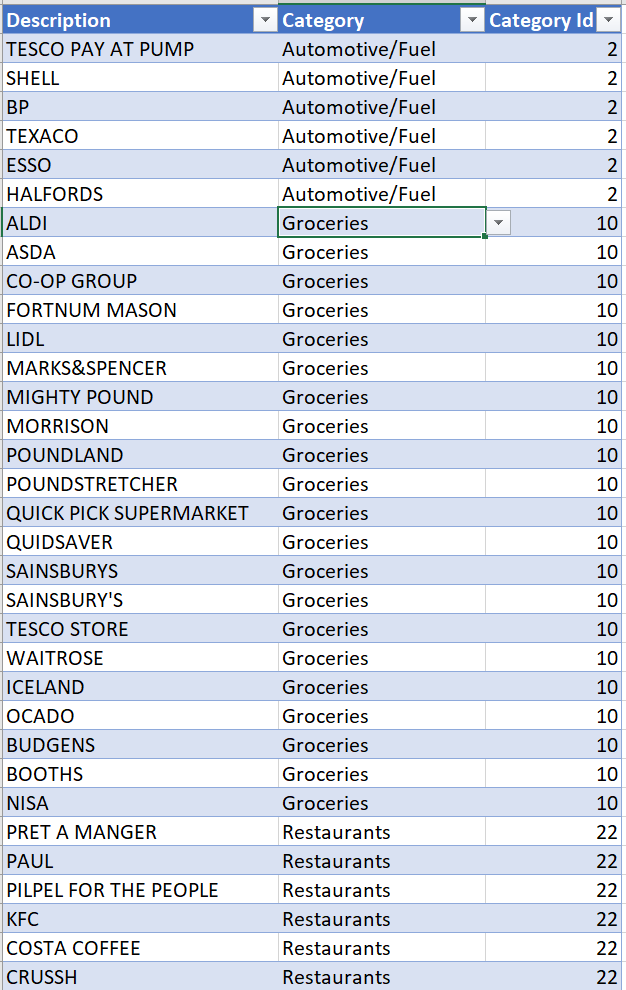

There are several approaches to transaction classification using machine learning. One popular approach is to use a supervised learning algorithm, where a model is trained on a labeled dataset of transactions. The model learns to associate certain transaction features, such as the transaction amount, date, and merchant name, with a specific transaction category. Once the model is trained, it can be used to classify new transactions.

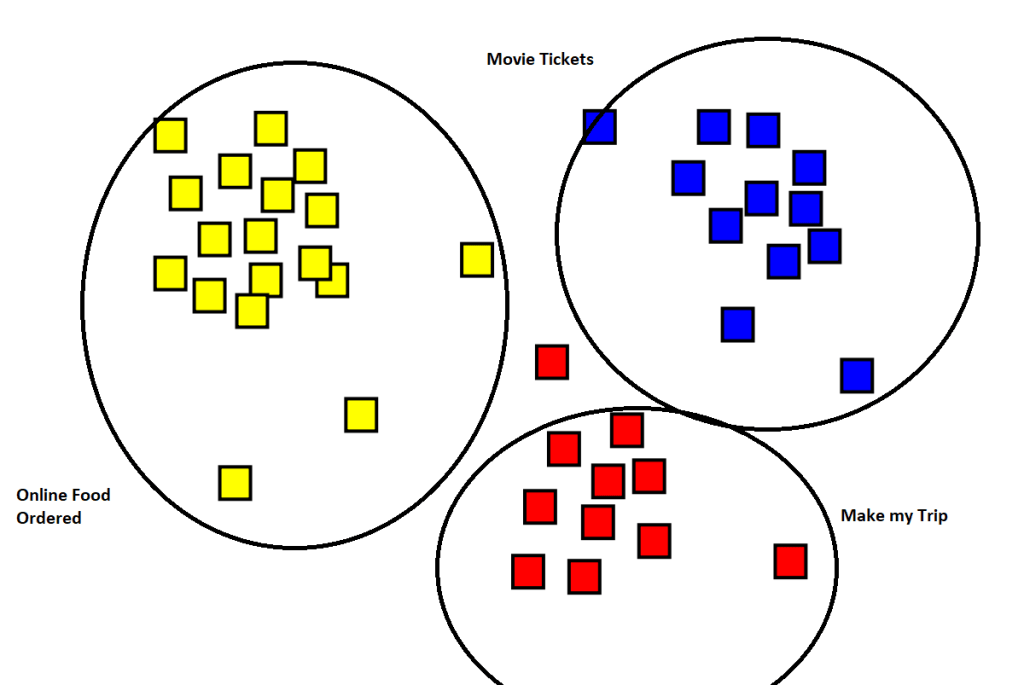

Another approach is to use an unsupervised learning algorithm, such as clustering or anomaly detection, to identify patterns in the transaction data. This approach does not require labeled data and can be used to discover previously unknown categories of transactions.

Regardless of the approach used, it is important to carefully select the transaction features used for classification. Factors such as the transaction amount, date, merchant name, and transaction type can all play a role in determining the correct classification. Additionally, it is important to continually evaluate and refine the classification model to ensure its accuracy over time.

In conclusion, transaction classification is an important task for organizations in various industries. By using automated techniques such as machine learning, organizations can accurately classify transactions at scale, gain insights into their business operations, and prevent fraudulent activity. With the increasing volume of transaction data being generated each day, transaction classification is becoming an increasingly important area for research and development in the fields of machine learning and data science.

Add Comment

You must be logged in to post a comment.