Business Intelligence Strategies for Banks Using SharePoint

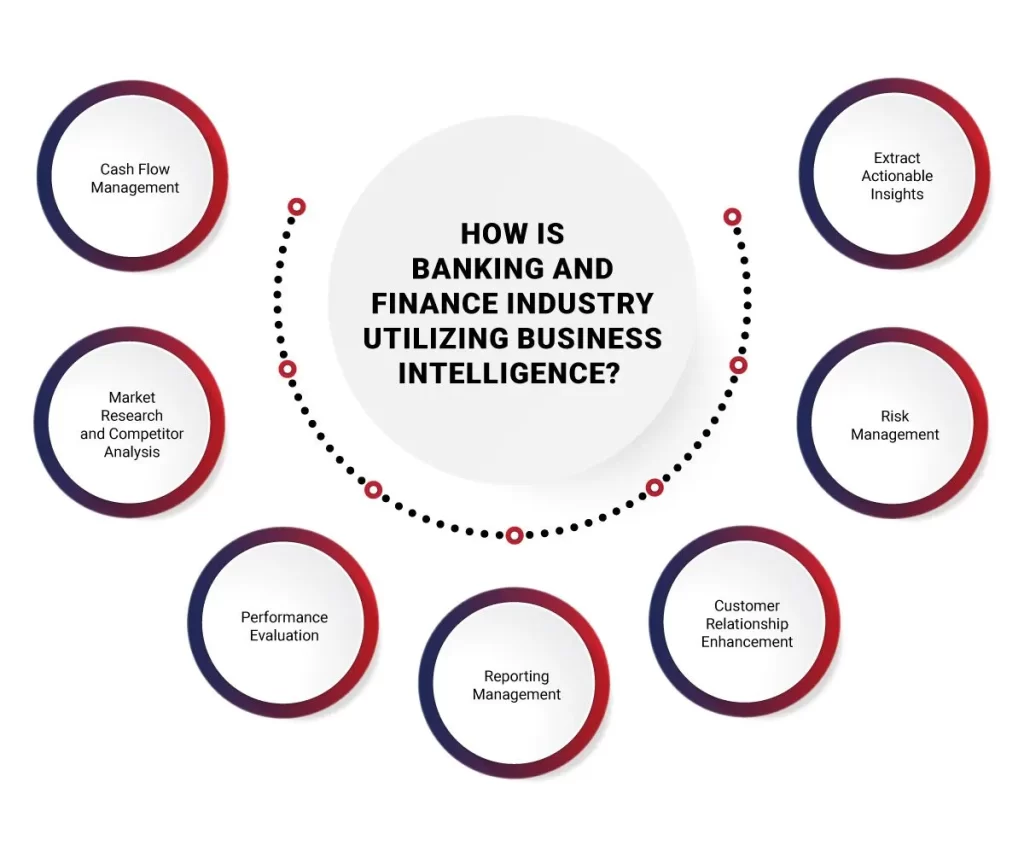

Business intelligence (BI) has emerged as a critical tool for banks seeking to thrive in an increasingly competitive and data-driven environment. By harnessing BI strategies, banks can gain valuable insights into customer behavior, market trends, and operational efficiencies, ultimately driving growth and profitability. Leveraging SharePoint as a BI platform offers banks a powerful framework to centralize data, facilitate collaboration, and generate actionable insights.

SharePoint’s robust document management capabilities, seamless integration with Microsoft Power BI, and advanced analytics tools empower banks to streamline processes, enhance decision-making, and mitigate risks effectively. Through strategic implementation of BI solutions on SharePoint, banks can unlock the full potential of their data assets, stay ahead of the curve, and deliver superior value to customers and stakeholders alike.

Key Challenges Faced by Banks in Implementing Business Intelligence

- Data Fragmentation: Banks often deal with fragmented data scattered across various systems and departments. This fragmentation makes it challenging to consolidate and analyze data effectively, hindering the generation of comprehensive insights.

- Regulatory Compliance: The banking sector operates under stringent regulatory frameworks, such as GDPR and CCPA. Ensuring compliance with these regulations while extracting insights from sensitive customer data requires robust security measures and meticulous adherence to privacy laws.

- Data Security Concerns: Banks are entrusted with sensitive financial information, making data security a top priority. Safeguarding against cyber threats, breaches, and unauthorized access requires robust security protocols and continuous monitoring.

- Scalability Issues: With the exponential growth of data volumes, banks face scalability challenges in managing and processing vast amounts of data efficiently. Scaling BI solutions to accommodate increasing data loads while maintaining performance and responsiveness poses a significant hurdle.

Leveraging SharePoint as a Business Intelligence Platform for Banks

Leveraging SharePoint as a business intelligence (BI) platform offers banks a comprehensive solution to their data management and analysis needs. SharePoint’s robust features and capabilities provide an ideal framework for banks to centralize data, facilitate collaboration, and generate actionable insights.

- Document Management: SharePoint’s document management capabilities allow banks to store, organize, and secure vast amounts of data efficiently. By centralizing data repositories, SharePoint ensures data consistency and accessibility across departments, enabling seamless integration with BI tools for analysis.

- Collaboration Tools: SharePoint fosters collaboration among bank employees by providing intuitive communication and collaboration tools. Teams can share insights, discuss findings, and collaborate on projects in real-time, enhancing decision-making processes and driving organizational efficiency.

- Integration with Power BI: SharePoint seamlessly integrates with Microsoft Power BI, one of the leading BI tools in the industry. This integration enables banks to create interactive dashboards, reports, and data visualizations, empowering stakeholders to derive valuable insights from data and make informed decisions.

- Advanced Analytics: SharePoint offers advanced analytics capabilities, such as predictive analytics and machine learning, enabling banks to uncover hidden patterns, trends, and insights in their data. By leveraging these capabilities, banks can identify opportunities, mitigate risks, and optimize operations effectively.

By leveraging SharePoint as a BI platform, banks can overcome data fragmentation, enhance collaboration, and drive data-driven decision-making across the organization. With its robust features and seamless integration with Power BI, SharePoint provides banks with a scalable and secure solution to their BI needs, empowering them to stay competitive in today’s dynamic financial landscape.

Designing Business Intelligence Solutions with SharePoint

Designing business intelligence (BI) solutions with SharePoint involves strategic considerations to ensure optimal functionality and usability. Here are key aspects to focus on

01

Data Modeling: An effective BI solution starts with a well-defined data model. Banks must carefully structure and map their data, ensuring consistency and relevance. SharePoint facilitates this process, allowing for the creation of a robust data model that supports accurate reporting and analytics.

02

Dashboard Design: SharePoint enables the creation of interactive dashboards that provide a visual representation of key performance indicators (KPIs). When designing dashboards, banks should prioritize simplicity and user-friendliness, ensuring that stakeholders can quickly grasp essential insights without unnecessary complexity.

03

Report Generation: SharePoint offers powerful reporting capabilities, allowing banks to generate customized reports tailored to specific user requirements. Designing reports should involve collaboration with end-users to understand their needs and preferences, ensuring that the generated reports are actionable and contribute to informed decision-making.

04

User Interface Customization: The user interface (UI) plays a crucial role in the adoption and success of BI solutions. SharePoint allows banks to customize the UI to align with their branding and user preferences. A user-friendly interface enhances the overall experience, encouraging greater engagement with BI tools across the organization.

By focusing on these design principles, banks can leverage SharePoint to create BI solutions that are not only technically robust but also user-centric. This approach ensures that stakeholders, from frontline staff to executives, can access and interpret data effectively, fostering a data-driven culture within the organization.

Ensuring Data Governance and Compliance

Ensuring data governance and compliance is paramount for banks to maintain trust, integrity, and regulatory adherence. Here’s how banks can achieve this using SharePoint

01

Security Features: SharePoint offers a range of security features to safeguard sensitive data. Banks can implement role-based access controls, encryption protocols, and multi-factor authentication to restrict access to confidential information. By enforcing granular permissions, banks ensure that only authorized personnel can access and manipulate data, mitigating the risk of unauthorized access or data breaches.

02

Access Controls: SharePoint enables banks to establish robust access controls to regulate data access based on user roles, responsibilities, and clearance levels. Banks can define permission levels for different user groups, ensuring that employees have access to only the information necessary for their job functions. Additionally, SharePoint’s integration with Active Directory allows for seamless user authentication and centralized access management, enhancing security and compliance efforts.

03

Auditing Capabilities: SharePoint provides built-in auditing capabilities that allow banks to monitor and track user activities, changes, and access to data. Banks can generate audit logs and reports to track data usage, document modifications, and user interactions, providing visibility into data governance practices and ensuring compliance with regulatory requirements. By maintaining comprehensive audit trails, banks can demonstrate accountability and transparency to regulatory bodies and stakeholders.

04

Data Retention Policies: SharePoint allows banks to define and enforce data retention policies to manage the lifecycle of information effectively. Banks can set retention periods, archival rules, and disposal schedules for different types of data, ensuring compliance with regulatory retention requirements while minimizing storage costs and data redundancy. SharePoint’s built-in compliance features facilitate the implementation of data retention policies, automating retention and disposition processes and reducing administrative overhead.

By leveraging SharePoint’s robust security features, access controls, auditing capabilities, and data retention policies, banks can establish a secure and compliant data governance framework. This framework ensures the confidentiality, integrity, and availability of sensitive data, while also facilitating regulatory compliance and risk management efforts in the dynamic and highly regulated banking sector.

Conclusion

In conclusion, leveraging SharePoint as a business intelligence (BI) platform offers banks a comprehensive solution to their data management, analysis, and governance needs. By harnessing SharePoint’s robust features and capabilities, banks can centralize data, facilitate collaboration, and generate actionable insights, driving operational efficiency, enhancing decision-making processes, and ensuring regulatory compliance.

Through strategic implementation of BI solutions on SharePoint, banks can overcome data fragmentation, streamline operations, and improve customer satisfaction. Realizing measurable improvements in operational efficiency, customer engagement, and profitability, banks gain a competitive edge in the dynamic financial services landscape.

Moreover, SharePoint’s security features, access controls, auditing capabilities, and data retention policies enable banks to establish a secure and compliant data governance framework. This framework ensures the confidentiality, integrity, and availability of sensitive data, while also facilitating regulatory compliance and risk management efforts.

In essence, SharePoint serves as a versatile platform that empowers banks to unlock the full potential of their data assets, driving innovation, growth, and success in today’s data-driven banking industry. By embracing SharePoint as a strategic BI platform, banks can navigate challenges, seize opportunities, and thrive in an ever-evolving financial landscape.